Overview

As State funding for capital projects has become less available for Illinois universities, there is a growing trend toward the examination and use of Public Private Partnerships (PPP) to deliver qualifying capital projects. In the simplest of terms, PPP projects have the advantage of using off balance sheet private capital and capturing private sector construction efficiencies.

Use of the design build process to deliver capital projects results in a more cost efficient and timely project delivery method than what is achievable within the State’s overly regulated capital delivery procurement process. The university does relinquish control over certain traditional roles when using a PPP and must agree to various financing conditions, which are dependent on the projects’ financing structure and economic viability.

Developer Equity Model

There are various types of Public Private Partnerships (PPP). In the University of Illinois System, PPP projects have involved the long term leasing of land for new private buildings for mixed use facilities and UIUC Research Park office buildings. These are developer-financed assets residing on university land via land leases that revert the asset back to the university in 50-75 years. In these scenarios, the university may not be the primary tenant of the facilities and the facilities are not used solely for university purposes.

The financial feasibility for these buildings is not dependent upon the university as the primary tenant, the developers’ rental space is marketed to private users and the debt is off balance sheet to the university. The developer equity model does not work well for academic or otherwise custom university facilities where the university is the only available tenant to the developer due to the limited length of lease available for the university. The universities in Illinois are prohibited by the Illinois Procurement Code (30ILCS 500/40-25) from entering into a lease with a term beyond 10 years inclusive of options. The universities must also follow the Procurement Code with a request for information (RFI) process that is an open process.

When developing custom space, the developer attempts to limit risk with a longer lease term in parallel to the long-term financing. The developer equity model is limited in meeting custom space needs of the university until regulatory changes can be made. While this model transfers all development and building maintenance risk, the university must wait significantly longer (as much as 50-75 years) to receive the asset. The 501c3 model delivers the asset upon the retirement of debt, which is a much shorter period.

The 501c3 Non-Profit Model

In Illinois, there are three examples of a non-profit approach to PPP projects that have involved the use of a not-for-profit entity to finance dormitory projects in a manner that return the asset to the university in approximately 30 years. In some narrow instances, this process can deliver custom facilities for leases back to the university to meet academic program needs when done in conjunction with a dormitory project. Northern Illinois University (NIU), Northeastern Illinois University (NEIU) and Illinois State University (ISU) have constructed dormitories and cafeteria facilities using this approach and have successfully navigated the complex and restrictive procurement laws of the State. This PPP approach utilizes a very limited number of national housing non-profit 501c-3 organizations that have been created for special purposes and have been approved by the IRS as tax-exempt financing conduits.

In some instances, the use of bond proceeds may not only be limited by the financing conduit to housing, but may also include ancillary academic facilities. The University of Illinois Chicago (UIC) will have the fourth such project in Illinois utilizing the 501c3 tax exempt PPP model. The UIC project has both an academic space component and a dormitory component; the academic space is $24 million of an $80 million mixed use project.

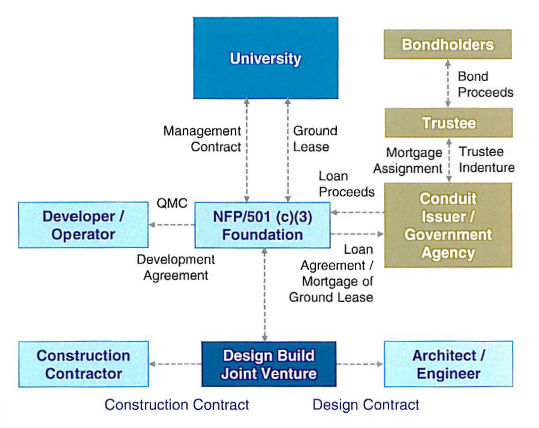

In this PPP model, the University contracts with a 501-c3 foundation which contracts with a developer, construction contractor, architect, engineer, and uses a conduit government agency (Illinois Finance Authority) to issue debt (see Figure 1 – 501-c3 PPP Structure). The University does not directly contract for any of the construction services and benefits from the tax-exempt financing and the transfer of design/construction risk for a date-certain project delivery. Typically, there is a facility management contract with the 501c3.

The University terms of the land leases and development agreement require certain covenants that apply to the project including, but not limited to prevailing wage requirements, design parameters, and other financial matters. The length of the land lease is for the term of the debt after which time the asset reverts to the university. In some cases, the university may purchase or retire the debt early, permitting ownership in a much shorter period.

Regulatory Considerations

Universities in Illinois have entered into PPP agreements via land leases which are concession agreements under statute not subject to the Procurement Code (30 ILCS 500/53-25). In order to promote an open and transparent process, the University of Illinois via Real Estate Services has utilized the Illinois Higher Education Procurement Bulletin to advertise real estate concession opportunities. The University conducts an “informal” RFP process. The response to the UIC project utilizing this process resulted in 9 national teams competing for the project. There is significant market interest in this approach.

Where a project involves the lease back of academic space, the project must be financed through the Illinois Finance Authority (IFA) under (30 ILCS 500/53-25 (c). The Procurement Code permits the “duration of any lease for real property entered into by that public institution of higher education as lessor or lessee, in connection with the issuance of those bonds shall be at the discretion of that public institution of higher education.” This allows lease terms to exceed the limitation of the Procurement Code of ten years. A term longer than ten years is key to financing academic space.

Property taxes are a major consideration in the developer equity model, which could add $500-to $1000 per dwelling unit in annual costs for housing projects. This has not been a legal issue for PPP projects in Illinois when on university lands utilizing the 501c3 model.

Building codes and zoning could come into play on a developer equity model based upon the circumstances.

Internal Considerations for 501c3 Delivery Method

Internal considerations will focus around debt obligations, design, delivery schedule and process for approvals.

There is approximately $1,100,000,000 in debt outstanding within the University of Illinois System for student unions, athletic facilities, housing and parking. The PPP projects cannot impair or otherwise negatively impact the ability to retire such debt, and the feasibility of a PPP project must early on assess such impacts. In some cases, existing bond covenants may prohibit or alter the proposed transaction. While the PPP transaction may be considered off balance sheet, it will have an impact on the University System credit rating, which must be understood in advance of the project as well as the necessity for credit enhancements in various forms. For non-student housing projects, the primary internal consideration is the long-term ability to fund the debt via the leaseback.

Design considerations should start with the university master plan and the appropriateness of the use within that context. Decisions regarding the site selection should be fully vetted within the campus site selection process with as much due diligence performed upfront as possible to limit university and developer risk. Due diligence should include a utility, easement, access, soils, environmental, survey, title and as much front end work as possible. The RFP must specify all design parameters including the use of campus design guidelines, LEADS requirements or other known design parameters. The approval process for design approval should be specified up front in the RFP as the developer agreement will require timeframes for approvals.

In terms of housing projects, the annual delivery date is locked in to each fall semester, so the delivery schedule must work from that date backwards. The developer timeframes for decision-making and university timeframes must be reconciled.

The approval process will require approval of various major documents including the land lease, space leaseback, maintenance agreement, risk sharing or predevelopment agreement, development agreement internally and via the University of Illinois Board of Trustees. The process must allow time for such approvals as required.

Projects to consider for PPP 501c3 financing on university land

The PPP 501c3 model only works on a project sited on university land with a land lease. Most dormitory projects would be eligible for the 501c3 model under the current regulations, assuming there is market demand and a growing enrollment. Housing projects with academic space, cafeteria space or other ancillary space not to exceed 50% of the bond proceeds are feasible, assuming there are funds are available or cash flow exists to pay the long-term rent. There is university and state-wide experience with this approach.

There is less experience with non-housing 501c3 projects. Preliminary research reveals that 501c3 foundations also exist to finance medical office facilities and general purpose academic buildings where there is sufficient revenue generated to pay the rent and any excess debt coverage. Real Estate Services has prepared and is prepared to solicit in February 2018 the first non-housing P3 in Illinois.

For more information contact:

Bruce Walden

Director Real Estate Service

University of Illinois

bwalden@uillinois.edu

217-300-6732